MSTR Stocks Hit New Low Amid Bitcoin Purchase Plans

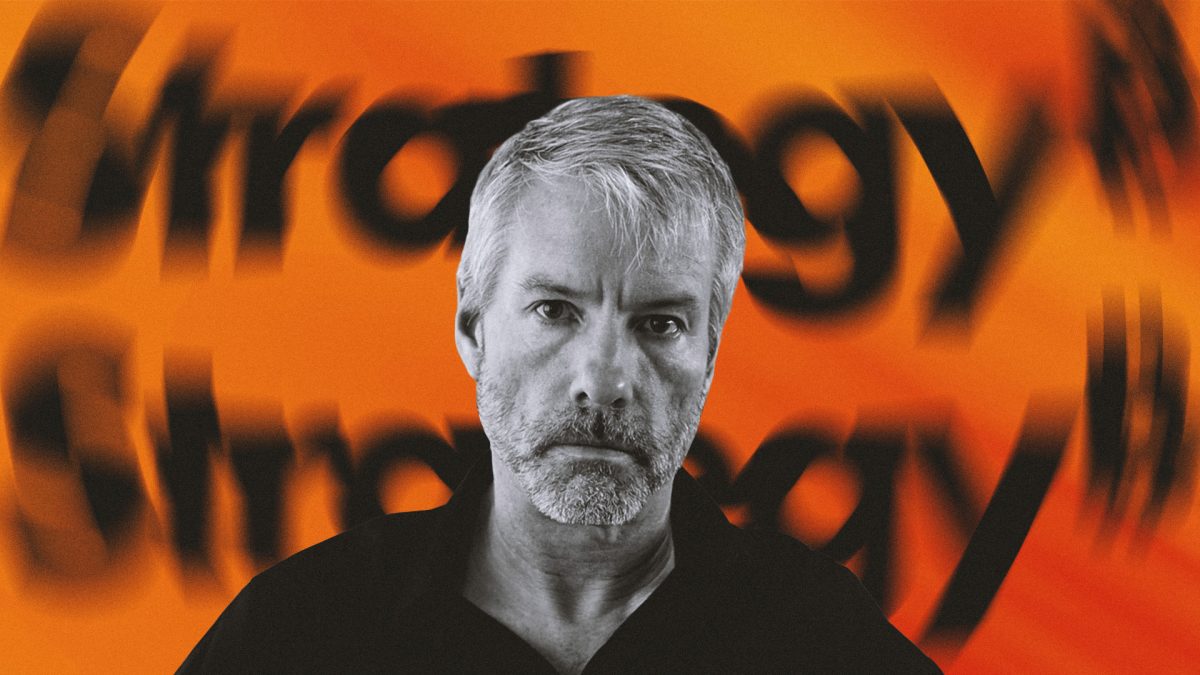

On Tuesday, Strategy's (MSTR) stock plummeted to its lowest level since April, falling 7.43% to close at $336.57, with a further 0.76% decline in after-hours trading. This marks a significant drop since its peak of $455.9 during the Bitcoin rally in July. The decrease coincides with Bitcoin's dip to approximately $113,000 and Strategy's recent decision to reduce the threshold for issuing shares to finance Bitcoin purchases. Michael Saylor announced on social media that Strategy is updating its MSTR Equity ATM Guidance to enhance flexibility in its capital markets strategy. This news has triggered backlash among current MSTR shareholders, as the updated policy permits share issuance when MSTR trades below 2.5 times its net asset value. This strategy aims to provide MicroStrategy with the necessary funds to cover debts and dividends. Investor @thorleifegeli expressed concerns, referencing a previous earnings call where it was stated that no shares would be issued below the 2.5x NAV threshold, questioning the rapid change in policy. The latest guidance emphasizes that MSTR may be issued tactically to meet obligations such as debt interest payments and preferred dividends. The announcement has raised caution among investors about the company's intentions. Additionally, fellow crypto-related companies like Bullish and Robinhood also experienced declines on Tuesday, contributing to a broader downturn in the sector, with the Nasdaq Composite falling 1.46%. Disclaimer: The Block delivers news and data independent of any one investor's influence. ©2025 The Block. All Rights Reserved. This article is for informational purposes and not financial advice.

FAQ

❓ What is MSTR's stock price trend?

MSTR's stock has hit its lowest point since April, dropping significantly.

❓ Why is MSTR expanding its stock issuance?

The company aims to raise funds for Bitcoin purchases, covering debts and dividends.