Augur Targets Bad Actors in Decentralized Market

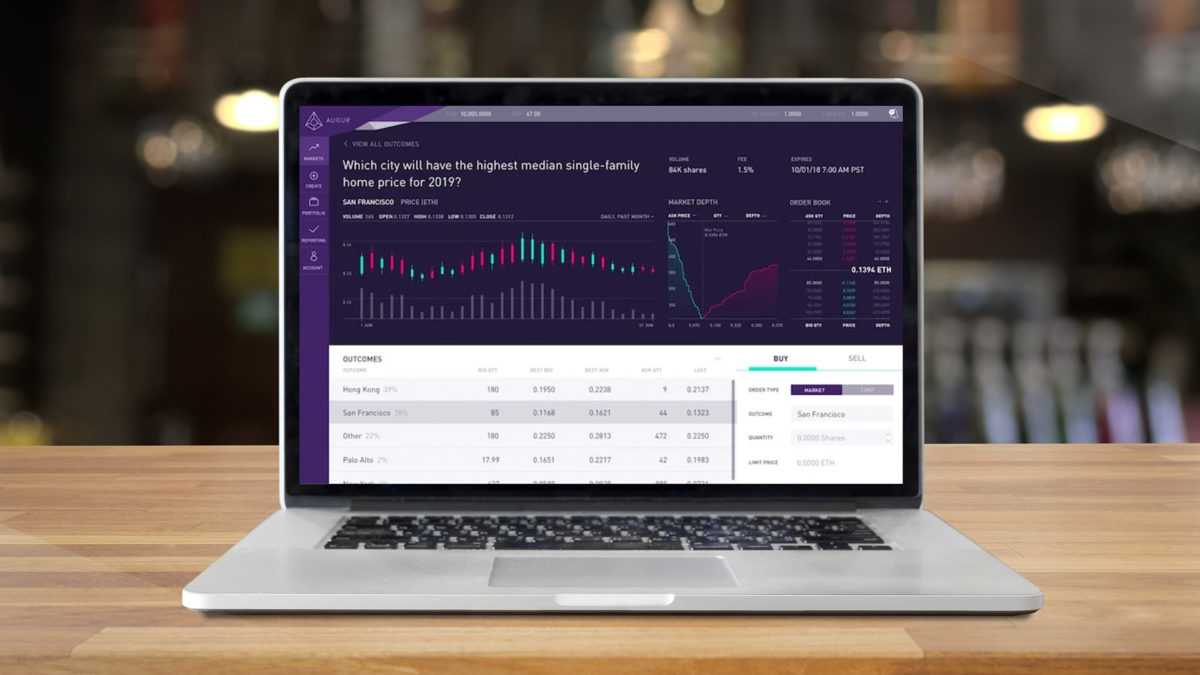

Decentralized prediction market Augur is intensifying its efforts to combat bad actors on its platform, as shared with The Block. Augur enables users to create markets based on event outcomes, where participants can buy ‘yes’ or ‘no’ shares, among other options. Winning bets yield an ether payout—one ether per winning share in a yes/no scenario, while losing bets receive nothing. In cases of unverifiable outcomes, 'yes' and 'no' shares receive a payout of 0.5 each, resulting in a total of one ether distributed evenly among outcomes. This is where unscrupulous players exploit the system, according to Augur. These individuals create invalid markets, often by timing the event's end to ensure an ambiguous result, such as placing it before the event occurs. They then purchase shares of the least likely outcome at less than the potential payout of the 'invalid' result. Although market creators must pay a validity bond, which is refunded when the market is validated, this fee is usually lower than the profits made from invalid markets, encouraging fraudulent behavior. **The Fix** To address this issue, Augur has launched a new app designed to highlight the most valuable markets for traders, discouraging users from generating invalid markets as the likelihood of payout diminishes. Ben Davidow from Augur’s growth strategy department stated, "The ultimate goal is to create a game where everyone wins, aligning individual incentives with the overall utility and security of the protocol." In essence, this new system filters out markets with wide spreads and low liquidity, preventing traders from manipulating markets with minor orders that suggest a competitive environment. By enhancing visibility for markets with tighter, deeper spreads and excluding those lacking bids or asks that would result in losses due to invalid resolutions, Augur aims to promote fair trading. However, this may lead to 'false positives' in markets genuinely priced around 50% probability. For version 2 of its protocol, Augur plans to allow users to trade invalid outcomes, which will eliminate potential profit from 'invalid' bets. For the moment, while the filters are not foolproof and some scammers may still navigate through, deceptive users attempting to place small orders could find their profits limited by the spread filter, thus reducing the appeal of their fraudulent schemes. Augur is not alone in battling scammers; other decentralized platforms like Bancor have also faced similar challenges and have hired specialists to address them.

FAQ

❓ What is Augur?

Augur is a decentralized prediction market platform that allows users to bet on the outcomes of various events.

❓ How is Augur combating fraud?

Augur has introduced new filtering systems in their app to discourage the creation of invalid markets.

❓ What happens in an invalid market?

In an invalid market, shares receive a payout of 0.5 ether each, regardless of the event outcome.